Surprisingly Strong 5Y Auction Stops Through, Concluding Day Of $100BN In Supply

After today’s ugly, tailing $50 billion, 2Y auction and amid general chaos in the bond market which saw both the 3s5s and 5s30s yield curves invert, the question was not if today’s sale of $51BN in 5Y paper – the second coupon auction of the day – would be ugly, but how much.

Yet, as always happens when everyone expected another dismal print in the belly of the curve, the auction came and it wasn’t that bad.

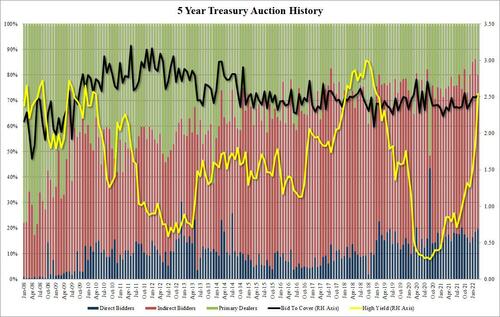

Printing at a high yield of 2.543%, the yield was – as expected – the highest since Dec 2018, and while it was a whopping 66bps wider than last month’s 5Y sale, it actually stopped through the When Issued 2.553% by 1bp, the third consecutive stop through for the tenor.

The bid to cover, likewise, was a pleasant surprise, and at 2.53 was not only stronger than last month’s 2.49, but was the highest since October.

Internals were a little weaker, with Indirects taking down 60.2%, below the recent average of 63.0% and down from last month’s 67.8%, and with Directs taking down 19.7% – the highest since Sept 2021 – Dealers were awarded a high 20.1%, the most since November. And since they can no longer flip that to the Fed as part of daily POMOs, we may see some additional post-auction pressure as Dealers rush to dump this ticking time bomb.

Overall, a solid auction in light of the burst of supply today and now all eyes turn to tomorrow’s 7Y belly buster which will need much more luck to pass as smoothly as this auction.

Tyler Durden

Mon, 03/28/2022 – 13:22