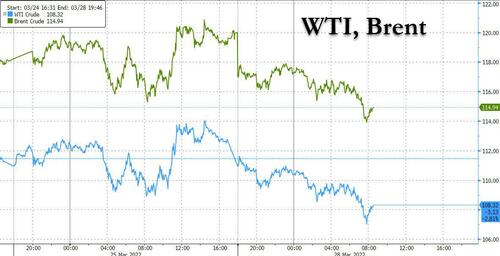

Oil Slides As Shanghai COVID Lockdown, Global Slowdown Spark Demand Fears

After Friday’s oil price surge, catalyzed by a Houthi attack on Saudi Aramco oil facilities in Jeddah, on Monday oil retreated as China’s worsening virus resurgence raised concerns about demand in the world’s biggest crude importer, while rebels in Yemen announced a three-day temporary pause in hostilities against Saudi Arabia.

WTI and Brent futures fell more than 4% each after authorities in Shanghai said they will lock down half of the city in turns for mass Covid-19 testing. Growth risks from inflation and tightening monetary policy also hit sentiments, pushing down sovereign bonds and equity markets were mixed.

Brent and WTI timespreads also waned, with outright prices dropping sharply to test support at short-term moving averages. Key North Sea swaps retreated on Friday. Money managers cut their Nymex gasoline short-only positions to the smallest since 2012. Diesel cracks also weakened on Friday. Money managers cut their net-long position on Nymex heating oil to the least bullish in more than 14 months. In the U.S., WTI Midland and HLS retreated to the weakest levels since November.

For those following gamma ICE May Brent crude options expiring today, the most-held nearby contracts are $115 calls, which are trading 21 cents above the May futures price of $114.79/bbl. Here is a summary of open interest of nearby puts and calls:

May Brent options contracts expiring total approximately 70,100 calls and 34,200 puts. May Brent futures expire on March 31.

While Russia has been excluded from many western-dominated organizations, that’s not the case with the world’s most importan oil cartel: the UAE endorsed the continued role of Russia in OPEC+, even as governments condemn Moscow’s invasion of Ukraine and buyers shun its cargoes. “Russia is an important member” of OPEC+ and is likely to remain in the group, Energy Minister Suhail Al-Mazrouei said today at a conference in Dubai. “This is an alliance to stay; this is an alliance we need.” OPEC+ leader Saudi Arabia has so far resisted pressure to break ties with Moscow by pumping more to partially replace Russian crude supplies affected by the international boycott.

In other news, as buyers across Europe and the U.S. shun Russian crude following the invasion of Ukraine, Russian oil is flowing to Asia in ever greater volumes: east-bound exports of flagship Urals and Siberian Light shipped from ports in the Baltic and Black Sea over March 1-23 were at the highest in almost two years, according to data from Vortexa. China and India have been the key buyers of cargoes, though the final destination of a tanker can still change during the journey.

Despite the boost in Asian flows, Russia’s oil exports from March 17 to 23 were down by more than a quarter from the prior week, according to industry data reported by Bloomberg. While the data didn’t include reasons for the drop, it occurred as Russia faced a growing movement by many of its usual customers to find alternate energy supplies after its invasion of Ukraine. Russia’s average daily exports over the period reached 495.3 thousand tons, down 26.4% from the week before, according the industry data seen by Bloomberg. That’s equivalent to an average 3.63 million b/d.

Meanwhile, according to Bloomberg Russian tankers carrying oil chemicals and oil products are increasingly concealing their movements, a phenomenon that some maritime experts warn could signal attempts to evade unprecedented sanctions prompted by the invasion of Ukraine. In the week ended March 25, there were at least 33 occurrences of so-called “dark activity” — operating while onboard systems to transmit their locations are turned off — by Russian tankers, said Windward, an Israeli consultancy that specializes in maritime risk using artificial intelligence and satellite imagery. That’s more than double the weekly average of 14 in the past year.

In other news, TotalEnergies doesn’t plan to divest its Russian assets amid the war in Ukraine, as doing so would essentially mean handing them over to President Vladimir Putin’s regime, CEO Patrick Pouyanne said. “For me it’s a question of accountability and the responsibility of the offshore stakeholders,” he said during a conference in Doha, Qatar on Saturday. “Do I give them for free to Mr. Putin? Because this is what it means ‘leaving today’ and giving my shares.” The French energy major earlier this week said it will no longer sign or renew contracts to buy oil and petroleum products from Russia, with the aim to halt all purchases by the end of 2022 at the latest, according to a statement.

Tyler Durden

Mon, 03/28/2022 – 09:02