Oil, Gold, Yen, & Yield-Curve Slapped Lower; Ruble & Crypto ‘Rock’et Higher

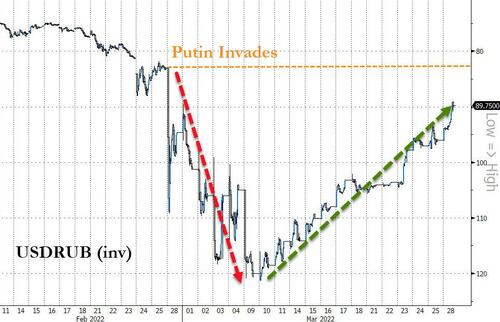

While oil plunged and crypto soared, perhaps the biggest news of the day was that the Ruble continued to charge higher, almost erasing all of the post-invasion losses…

Source: Bloomberg

And gold in rubles has fallen back towards CBR’s buying level announced last week…

Source: Bloomberg

Crude crashed on demand anxiety as China begins its lockdown in Shanghai. It was rescued briefly by OPEC+ headlines that they don’t care about temporary ‘war premium’ and will stock to their current supply plan, but that didn’t last long as the reports of progress in peace-talks sent WTI legging down further, settling with a $104 handle…

Bitcoin ripped back above $48,000 (and up to its 200DMA)…

Source: Bloomberg

…pushing it back into the green for 2022 and to its highest level of the year (Ethereum also surged up to $3400)…

Source: Bloomberg

‘Growth’ stocks soared with tech-heavy Nasdaq the clear winner but going into the last hour, reports of possible breakthroughs in Russia-Ukraine peace talks sent all the majors higher. The rally dragged The Dow just into the green along with the S&P with even Small Caps desperately ramped to a tiny gain on the day…

Growth outperformed value (energy and financials suffered today), slamming the Value/Growth ratio back to basically unchanged on the month..

Source: Bloomberg

Treasuries were a mixed bag today with the long-end outperforming amid a massive flattening (2Y +6bps, 30Y -2bps)…

Source: Bloomberg

But what was consistent was the worsening of yield curve inversions across almost the entire curve (5s10s, 5s30s, 7s10s, and 20s30s all inverted now). The rate of collapse in the yield curve is almost unprecedented…

Source: Bloomberg

The forward curve is already flashing red for recession with 1Y Fwd 2s30s now 41bps inverted!!!!!

Source: Bloomberg

The dollar rallied up to 2 week highs, retracing all the post-FOMC losses…

Source: Bloomberg

The dollar is being helped by the carnage in JPY…

Source: Bloomberg

Gold was smashed lower on the peace-talk headlines…

In context, Gold is getting close to the key $1900 level and the pre-invasion lows…

Finally, what is most glaring is that the market is now pricing in 9 more rate-hikes in 2022… which the market sees as guaranteeing a recession… and therefore the market is pricing in almost three rate-cuts in 2023/24….

Source: Bloomberg

With stocks only a few percent off their highs, do you think they are pricing in 9 more hikes this year?

Tyler Durden

Mon, 03/28/2022 – 16:01

Recent Comments