Stocks, Gold, & Oil Surge On Week As Yield Curve Carnage Screams ‘Recession’

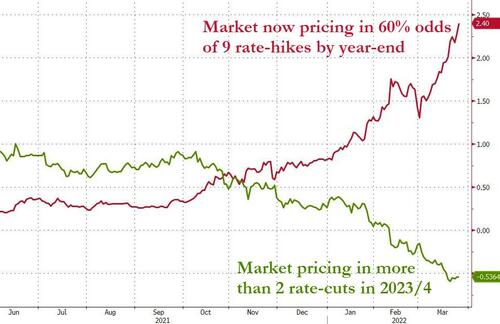

The ongoing hawkish push higher in market expectations for 2022’s rate-hike trajectory with 9 more rate-hikes now expected by the end of December. But as the chart below shows, as the hawkishness rises, so does the chance of a recession, and the market is expecting more than 2 rate-cuts starting next year…

Source: Bloomberg

Bonds were the story of the week as the bloodbath did not stop, especially at the short-end, with 5Y yields up a stunning 44bps (while 30Y was up ‘only’ 17bps)…

Source: Bloomberg

The bloodbath in bonds has sent the short-end and belly soaring in yields to the point that 5s30s got very close to inverting (for the first time since May 2006). The flattest 5s30s print today was just 1.3bps…

Source: Bloomberg

This long-spread joins 20s30s, 3s10s, 5s10s, and 7s10s in recession-screaming inversions…

Source: Bloomberg

It’s a recession! How do we know? “Because I was inverted…”

And so, amid all the surging rates and hawkish expectations, stocks managed gains on the week with Nasdaq and S&P outperforming while The Dow could not get much done and Small Caps closed lower. A late-daye panic-bid lifted Small Caps almost back to green on the week…

Wondering why the market went vertical into the close? Some algo wanted to hunt down the stops at the 100DMA…

VIX appears to be pricing in ‘peace’ this weekend as it closes at a 20 handle…

The early week short-squeeze faded on Thursday and Friday as ammo ran out…

Source: Bloomberg

Energy stocks strongly outperformed on the week with Healthcare the laggard. Financials managed modest gains…

Source: Bloomberg

On the week the very recent trend of growth outperforming value stalled – after erasing value’s relative outperformance from the start of the month…

Source: Bloomberg

Oil prices ended higher on the week amid an avalanche of Russia/Rubles, Iran nuke deal, pipeline closures, and storage facility attacks. PMs were also up on the week but copper ended lower…

Source: Bloomberg

The dollar ended the week modestly higher, bouncing off unch twice during the week..

Source: Bloomberg

Cryptos rallied on the week with ETH and BTC up around 6%…

Source: Bloomberg

Interestingly, financial conditions in US, Japan, China, and Europe all stopped ‘tightening’ this week…

Source: Bloomberg

Finally, we note that as mortgage rates have exploded higher – at their fastest pace in decades – they have also decoupled dramatically from 10Y Treasury yields – now over 200bps above 10Y.

Source: Bloomberg

As Mike Shedlock notes, six of the last seven recessions began shortly after the spread exceeded 200bps, warning that “We are now in the danger zone.”

And the forward Treasury curve is inverted in 2s10s, another high conviction recession signal…

Source: Bloomberg

Given that we are suffering the worst drawdown in global bond prices on record…

Source: Bloomberg

We could perhaps expect some rebalancing/rotation (buy bonds, sell stocks) early next week.

Tyler Durden

Fri, 03/25/2022 – 16:01ZeroHedge News