Nickel Halted Limit Up Again As Chinese Tycoon Begins Covering Giant Short, Sparking Fears Of Another Mega Squeeze

For the second day in a row, Nickel traded in London surged by the 15% exchange limit on the scandal-plagued London Metals Exchange, putting the spotlight back on bearish position holders just two weeks since the market was roiled by an historic short squeeze, and sparked speculation that a second, even more vicious short squeeze may be forming.

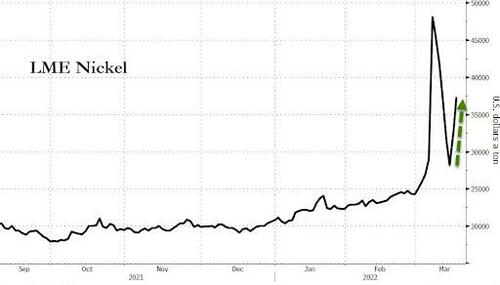

Nickel futures remained locked at the price limit by late morning on the London Metal Exchange, as the latest spike extends a period of unprecedented turmoil for the market. Prices soared over 250% over two trading sessions in early March during the short squeeze centered on China’s Tsingshan Holding Group Co., before the market was suspended to avoid bankrupting China’s biggest stainless steel producer and potentially leading to billions in losses for its OTC counterparties, among which JPMorgan was the largest.

As we reported last week, Tsingshan struck a deal with its banks to avoid further margin calls, allowing the market to reopen last week, and said it would reduce its short position in the future. But the sharp two-day jump will be piling pressure on its banks and brokers who have to make margin calls of their own to cover short positions on the LME when prices rise.

Speaking to Bloomberg, Michael Widmer, head of metals research at Bank of America, said that “ultimately the short position is still out there, and they will have to close it out” adding that sharp daily price moves are likely to continue “at least until the short position is out of the market.”

And sure enough, in a separate report from Bloomberg today, we learn that Xiang “Big Shot” Guangda, the owner Tsingshan, bought some contracts on the London Metal Exchange to reduce his short bet as the nickel market briefly unfroze this week.

Tsingshan and its peers have covered tens of thousands of tons of their short positions, one of the people said. Xiang had short holdings of over 150,000 tons when the market was halted on March 8, and his business and trading partners held additional large short positions on top of that – Bloomberg

While the move modestly reduces the size of the potential pain for Xiang and his banks as nickel prices soar once again – prices on the LME are up more than 30% over the past two days – the risk is that now that markets know that the big short is covering, they may refuse to sell any metal at any price forcing yet another squeeze. Indeed, as Bloomberg first reported, the businessman and his allies have only reduced a portion of their total short position, and still hold large bets on falling prices.

On March 10, Bloomberg reported that Xiang told his banks that he didn’t want reduce his short position; that clear lie – which removed the possibility of a squeeze – helped send the nickel price sharply lower since then, falling as low as $26,675 a ton this week, compared with $48,078 a ton on March 7 — the last price that the LME allowed to stand when it closed the market. Clearly, Xiang was lying, and has been quietly seeking to cover at least some of his short.

The LME reopened the nickel market last week after Tsingshan announced a deal with its banks to avoid further margin calls; in the meantime, and following an unprecedented trading suspension, the LME canceled billions of dollars of transactions sparking outrage among the industry and destroying overnight any positive reputation the exchange may have had.

While Tsingshan holds an outsized short position on the LME, there are many other industrial users and physical traders who hold short positions to hedge their price risk, raising the threat of another squeeze if those parties need to buy their positions back, or brokers seek to close them out to avoid further margin calls.

Total short positions held by commercial parties stood at 74,166 contracts at the end of last week, according to data from the bourse. As Bloomberg correctly notes, they’ll need to turn to bullish hedge funds to liquidate their contracts: on a net basis investment funds are the largest holders of long positions in the LME nickel market.

That said, once the shorts come under renewed pressure – and now that Xiang is covering it’s just a matter of time – the new daily price limits introduced by the LME should help prevent a repeat of the extreme price swings seen earlier this month. On the other hand, if the buying pressure is big enough, we may just end up with a locked market, one where every single day we see Nickel trade immediately limit up and stay there, only to repeat that again the next day.

Finally, and perhaps confirming that we are about to see another huge squeeze, overnight nickel also surged to the maximum daily limit on the Shanghai Futures Exchange earlier – tracking the overnight gain in London – despite a cloudy short-term demand outlook due to Covid-19 restrictions in China. It indicates that traders are looking for venues where to go balls to the wall long, knowing that they may not have much chance on the LME once it locks limit up for the foreseeable future.

Tyler Durden

Thu, 03/24/2022 – 14:01

Recent Comments