Goldman Now Expects Yield Curve To Invert Next Quarter, Sees Inversion Lasting Three Years

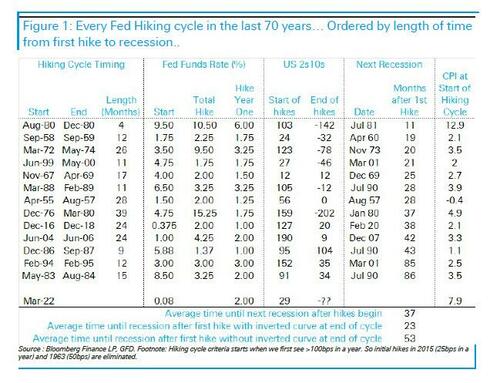

Yesterday, in our discussion of the “battle of the yield curves“, where we made it clear only the 2s10s matters due to its infallible recessionary signaling, we pointed out that while on average it takes 12-18 months from inversion to recession during a Fed hiking cycle…

… not only has the Fed never before started a rate hiking cycle when inflation was already 7.9% (suggesting that the onset of a recession will be much faster than usual this time), but that the debate over a yield curve inversion (and thus recession) was already moot, as the 2Y forward 2s10s had inverted and on Thursday the inversion accelerated taking out the inversion lows hit in 2006 ahead of the global financial crisis.

The only question at this point is when the inversion will take place, and begin the official countdown to a recession which BofA CIO Michael Hartnett believes will start some time in the second half.

Well, moments ago we got an answer from Goldman Sachs, which this afternoon – just hours after we showed that the forward 2s10s had already inverted, updated its forecasts for US Treasury yields across the curve “to reflect more broad-based and persistent price pressures and the accompanying hawkish Fed pivot.”

As a result, Goldman now sees the 10y UST yields ending the year at 2.7%, up from its prior projection of 2.25% (the bank notes that risks to its forecast are two-sided: on one hand “a deescalation of the war in Ukraine or more persistent inflation could mean even higher realized levels”, whereas the opposite could result in lower levels).

Goldman’s forecast revisions at the front end far larger: the 2y forecasts for YE22 and YE23 are 2.9% and 3.15%; while the former is only about 20bp above current forwards, the latter is roughly 50bp higher, reflecting Goldman’s higher terminal rate assumption… which incidentally are dead wrong because as we showed recently, the terminal rate (dashed line below) continues to slide as a result of record-er debt and shrinking output and productivity.

Its woefully wrong terminal rate assumptions aside, the bank also expects that longer maturities will increase more gradually given the bank’s expectations for strong demand from liability-driven investors. As such, the vampire squid now expects the 30y yields to end the year at 2.75%.

To summarize yet another bafflingly clueless Goldman forecast, the bank now expect the 2s10s yield curve to invert next quarter, and to remain inverted until Q2 2025… without any dire economic consequences. In other words, in some bizarro universe, Goldman sees the US financial sector existing under an inverted yield curve for exactly three years, and even more magically, the US somehow manages to avoid a historic depression during this period.

Not surprisingly, even Goldman concedes that this makes little sense, and tries to explain away its ludicrous forecast by saying that it’s bad… but not as bad as it was in the 1970s. Which, considering the amount of debt in the economy and the hyperfinancialization in the markets, is a completely spurious and meaningless comparison (if the US was to undergo through a 1970s style stagflation, the S&P would crash 90%), and is precisely why Goldman used it:

A notable aspect of our forecasts is that they feature a roughly 20bp inversion of the 2s10s UST curve as we progress through the year. Although this appears significant in the context of the business cycles since the late 1980s, where this curve has not inverted by more than 50bp ahead of a recession, inversions were significantly more pronounced in the 1970s and early 80s (Exhibit 4). We’ve argued in a previous report that earlier and/or deeper nominal curve inversions should not be that unusual in high inflation environments with significantly inverted inflation curves, requiring only modest flattening of the real yield curve flattening. As a result, in such periods we think modestly inverted nominal curves are a less definitive signal of recession probability than when using information about both the real and inflation curves.

What’s the take home message here? Well, Goldman is right in predicting that the 2s10s will invert as soon as next quarter – after all, we said just that last night – and as we also explained, this means that the next recession could start as soon as 11 months after the first hike (last week), and potentially much sooner considering where inflation currently is. The rest of Goldman’s note – namely the part about how one can ignore the recession and it’s really no big deal – one should simply ignore.

Actually, there is another reason why one can ignore most if not all of the above: with the act of hiking, the Fed has doomed the US, because as this chart from Deutsche Bank makes clear, in the modern (fiat high debt) era, every single Fed hiking cycle has led to some kind of financial crisis somewhere across the world

Masochists can read much more in the full note available to pro subscribers in the usual place.

Tyler Durden

Thu, 03/24/2022 – 15:20

1