Used Car Prices Fall As Goldman Points Out Supply Chain Alleviation

U.S. companies has struggled with supply chain congestion, bottlenecks, and the inability to adequately re-stock certain items that roiled the automotive industry. As a result, new car production has been hindered as consumers panic bought used cars, sending prices sky-high.

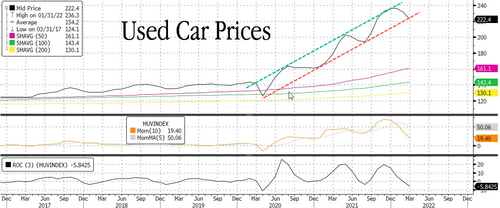

On Feb. 9, we outlined a major inflection point for the Manheim Used Vehicle Value Index, a wholesale tracker of used car prices, possibly topping as peak supply chain constraints had passed and more parts would be readily available for automakers to restart and or increase output for new vehicles. At the time, we said this could reverse used car prices. However, we also noted that this inflection point might lead to false positives if supply chain congestion persisted.

More than a month has passed by since we noted the inflection point. And to possibly validate peak supply chain constraints is Goldman Sachs’ Jordan Alliger, who told clients Monday that high frequency weekly supply-chain data for the week ending Mar. 14 shows signs of bottleneck relief.

As bottlenecks subside, the Manheim Used Vehicle Value Index declined 3.8% in the first 15 days of March compared to the full month of February. The used car index is still up 24.1% compared to March 2021 at around 222.4. Though momentum and rate of change indicators show soaring used car price trends are drastically slowing as supply chains crunches resolve.

Goldman’s Alliger reveals high frequency weekly supply-chain data improved last week to a score of 5, versus 7 after holding 8 for the prior two weeks. The weekly index has declined 11.6% sequentially

“While a 6 still indicates a bottlenecked supply chain environment (marked by demand greater than transport capacity, and still hyper-elevated shipping rates), the recent trendline continues to point in the right direction,” Alliger said.

The analyst did say there’s possibility congestion will “re-emerge as inbound traffic arrives in March into a still congested U.S. logistics system; and container shipping rates – which are part of the index – could see some impact from the Russia/Ukraine conflict,” though supply chain congestions are subsiding.

Similar to JP Morgan’s belief in early February that supply chain constraints have passed their climax, Goldman’s analyst points out peak congestion might have passed as well.

“While our base case for more extended supply-chain easing does not arise until sometime midyear-2022 (at the earliest), we do think some slight easing on the ocean side is possible as we move further into 2022, as we approach seasonal post-peak shipping for container ships due to the length of time it takes to move from Asia to the U.S.,” Alliger said.

There’s already an improvement in the number of container ships waiting to dock, significantly down from the highs observed earlier this year. A sign port congestion is improving.

Another sign the logistical nightmare over the last two years is abating are international shipping rates that have not just peaked but are coming off their highs.

So if supply chain fluidity is improving, automotive manufacturers will begin to receive the much-needed parts they’ve been craving: semiconductor chips. In return, new car production may increase, which would flood the car market with news ones and could lead to more downside for used car prices.

What remains of interest is how supply chains will be impacted after Russia invaded Ukraine. For now, used car prices are falling.

Tyler Durden

Tue, 03/22/2022 – 22:25

Recent Comments