The Fed’s Biggest Inflation Problem: Record Surge In Equity Asset Prices

By Joe Carson, former chief economist at Alliance Bernstein

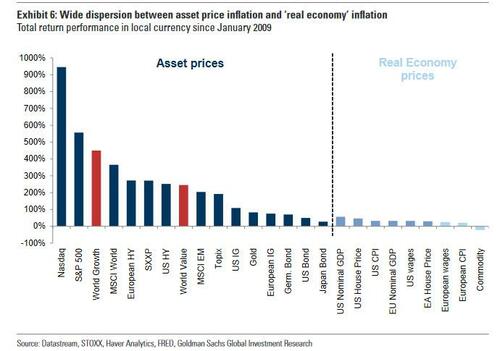

The Fed finally admits it has an inflation problem. Yet, what is the bigger inflation problem and potentially more destabilizing to the economy as it unwinds? Is it the 40-year high in consumer price inflation, or is it the surge and record valuations of asset prices? Of course, policymakers would say it’s consumer price inflation. However, I would argue its asset prices since easy money has fueled a record surge in equity prices, lifting macro valuations far above the dot.com bubble.

Asset inflation has been a dominant feature of business cycles for the past two decades or more. And, over the past two years, helped by an avalanche of liquidity as the Fed doubled its asset balance sheet to $8.5 trillion, the market valuation of domestic equities to nominal GDP (i.e., the Buffett Indicator) has jumped to levels never thought possible. At the end of 2021, the market value of domestic equities to nominal GDP stood at 2.55.

It is worth noting that before the pandemic, the Buffett Indicator hit a record high at the end of 2019, surpassing the peak level of the dot.com bubble. In other words, the Fed’s easy money policies that resulted in an over-valuation of equities at the end of 2019 created a mind-boggling extreme over-valuation at the end of 2021.

To put the equity market’s valuation in perspective, if equity prices dropped 25% in 2022, or a decline four times bigger than the decline in the S&P 500 to date, that would only bring the Buffet Indicator back to the peak of the dot.com bubble. And a drop of nearly double that scale to bring it to the average of the past two decades.

Before the last two years, history shows several years of negative returns following periods of extreme overvaluation. Yet, the S&P equity index has jumped nearly 50% over the past two years, while the Nasdaq is up over 80%. So instead of correcting in value, the equity market moved into a new orbit of over-valuation.

If there are laws of gravity in finance, the equity market is in for a big hurt. That’s because monetary policy is a blunt instrument. As policymakers use traditional and non-traditional monetary policy tools to kill the consumer price inflation cycle, it will hit asset prices hard. Moreover, given the scale of over-valuation, the potential decline in equity prices could rival the “big” ones of years past. So investors should take note: history sometimes repeats itself in the world of finance.

Tyler Durden

Tue, 03/22/2022 – 14:00