Who Needs Who?

By Peter Tchir of Academy Securities

What a Week!

Last week started with immense selling pressure across all stocks and bonds. It included one of the few days where not only were stocks down 2% or more, but the 10-year Treasury yield spiked 14 bps to 2.14%. Even commodity prices were dropping on Monday (certainly energy related commodities).

There was a lot of chatter about risk parity strategies and every second conversation was about the dollar’s status as a reserve currency.

That panic subsided and the Nasdaq rose more than 10% from its lows. Peace shifted from a glimmer of hope to a real hope. The Fed hiked, but did it about as dovish as possible (I think that they will use the minutes to spook markets and the pace of hikes might be slow and data dependent, but the balance sheet reduction is going to be aggressive). Finally, on Friday, Biden and Xi spoke, which seemed to comfort markets. I am not sure why the market took the conversation as a positive. Yes, Xi did say that the invasion “is not something we want to see,” which I guess sounds good, but I’m not sure it indicates that China will change its behavior, which is what I want to address with “Who Needs Who?”

But before that, I must point out one thing that is quite baffling!

The Sawtooth Yield Curve

I do not think that I can remember a time when the curve was steep out to 3 years. Then it is somewhat flat until 7 years, inverts between 7 and 10 years, steepens dramatically out to 20 years, and finally inverts from 20s to 30s. There were times last week that 3s and 10s were inverted. This sort of yield curve looks like something you’d see from a corporation with small issues (issued years apart) with a wide range of coupons, not something you would expect to see in U.S. Treasuries. Truly the strangest curve I’ve seen in years!

Something seems “wrong” in the rates market, even with the risk rally that continued unabated from Wednesday’s Fed press conference right into Friday’s close.

Maybe, now that many shorts have been squeezed and the bulls seem euphoric, we will figure out what this yield curve means and whether risk assets have gotten ahead of themselves.

This brings us back to the main topic of this weekend’s T-Report.

Who Needs Who?

No one is talking about the decline of the dollar as the world’s reserve currency, but maybe we should be. People are instead talking about how effective sanctions are and how they might tilt Russians and the oligarchs against Putin, so maybe we should examine that theory. Since we took Xi’s comments as an indication that he doesn’t support the war, maybe we need to question that too?

The one thing I hear a lot, especially in the bullish conversations lately, is that “they” need “us” more than “we” need “them.” Whether it is innate American exceptionalism coming through, or something else, I am not sure that those statements are true (while acknowledging that the “us,” the “we,” and “them” are a bit vague).

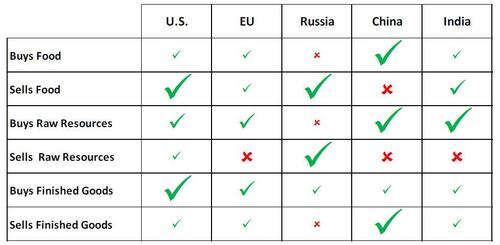

So, when thinking about “who needs who,” I thought it might be interesting to build a very crude table to help think about it. It is crude, simplistic, and not at all rigorous in terms of underlying data, but probably good enough to illustrate a point.

Anywhere you have a large check mark in one country and a corresponding red X in another, there should be the possibility of doing business.

When looked at through this simple lens, China and Russia are perfect bedfellows. What China needs, Russia has, and vice versa! India, which is a net food exporter, isn’t quite as perfect of a match, but maybe we can see why India has been reticent to join sanctions on Russia?

I didn’t add the Kingdom of Saudi Arabia, as they don’t align well with Russia, but they do align well with China.

I didn’t add Iran or Venezuela, both countries the U.S. has reached out to for oil and gas, because that didn’t fit this chart, but it does open another parallel dialogue – “closeness.”

In any case, I think that if we think about what countries “need,” especially at the basic levels of food, raw materials, and finished goods, it is far less clear that other countries need “us” (the U.S. and Europe) more than we need “them.” That is already occurring and will continue to occur.

Closeness

I continue to believe that we are moving towards a realignment of global relations. Closeness will be a key factor in how those relationships are prioritized. Closeness can mean:

Physical proximity. It makes sense to increase trade with countries where it is easy to ensure the smooth delivery of goods back and forth. This creates far less risk of disruptions, especially if more countries resort to projecting their military might.

Similar political or moral views. The Russian invasion has highlighted how important it is to have ties to countries that think and behave according to the norms you view as acceptable. The U.S. had already targeted regions in China (for their suppression of the Uighurs), Iran, and Venezuela, so dealing with sanctions in those countries seems to be an increasing risk.

There are two sides to this coin.

Let’s go back to the Kingdom of Saudi Arabia. They are not particularly well aligned with us from a “political” standpoint. They know that we are trying to wean ourselves off their fossil fuels while at the same time, we don’t agree with how they treat their citizens, etc.

Could we see a shift over time where they move closer to China, which doesn’t care about how their “partners” treat people, so long as they supply what China needs? China also seems likely to be a longer-term buyer of traditional fossil fuels than the West.

Total Return Swaps

This might look like a total non-sequitur, but there is some method to the madness.

At Bankers Trust (BT) in the 1990’s, we did total return swaps. We would pay the total return of an asset to a client versus receiving a financing fee. The total return swap business is a common practice today, but I wanted to highlight a few things about what we did that are relevant to today:

The salespeople functioned as Bankers Trust Securities employees. BTSec had the best protections from a legal standpoint on the sales side, so it was used.

Bankers Trust International was the London Branch of Bankers Trust NY and was the entity that faced clients. The ISDA is better done out of London and we had other regulatory reasons for using that entity.

In the case of leveraged loans (the bulk of what we did), it was best to own those assets in Bankers Trust New York (the U.S. bank) and pass the net returns to BTI.

I illustrate this “simple” arrangement to show how well-regulated entities can figure out ways to move money around the globe efficiently and legally.

So, for all those who seem to think that countries won’t be able to figure out how to trade without the dollar, I don’t believe it for a second.

China has been pushing the IMF to increase their currency’s percentage in the SDR. They have been encouraging trading oil and gold futures in their currency. They have almost certainly been suggesting to central banks that they should hold Chinese bonds in proportion to their SDR representation or more.

If you are a country that is not “close” to the U.S. and you are witnessing the issues that Russia (its Central Bank in particular) is facing from sanctions, maybe you need to think twice about what you hold. If we can “weaponize” the dollar or Treasuries, then it changes the calculus on what you should hold (or at least I think it will).

Who Really Needs Who?

I am far from convinced that the narrative of “them needing us more than we need them” is correct.

While the near panic early last week about the de-dollarization was overdone, I think that is a risk that is real and increasing. It will take time, but if China continues to buy Russian products, then why wouldn’t other countries look to make arrangements with China, especially if they aren’t “close” to us? Despite Xi’s comments, there is no indication that they will stop. Nor, as far as I can tell, is there any indication that India will stop securing natural resources at extreme discounts.

How can we tell if this shift away from the dollar is occurring?

I don’t know, but I think that we can look to a few things:

Dollar weakness and Yuan strength. A bit messy, especially when one isn’t freely traded, but something to watch.

“Intermediate” assets rising in price. Could we see money shifted into things like gold or crypto as they make their way out of dollars and into other currencies?

Any TIC data that shows countries that are not “close” to us reducing their Treasury holdings. Since most countries tend to own shorter dated Treasuries, this would put pressure on the front end of the yield curve.

I’m not sure that we need to react to this today, but it is something to think about (especially since so many people have mentioned that China is stockpiling commodities, in what could be viewed as a step towards “sanction proofing” themselves).

Bottom Line

I am less hopeful today than I was last weekend, and far less hopeful than on Tuesday that a ceasefire or real peace is likely. I hope I am wrong on this, but I believe this will grind on, which leaves us back to worrying about all the 2nd and 3rd order effects discussed last weekend.

I am befuddled by the shape of the U.S. Treasury curve. The kinks point to issues other than reacting to Fed policy (I think). I don’t always agree with the shape of the curve, but often, I can understand it from a macro standpoint, but this looks to me very much like micro issues and a sign of poor liquidity in what should be the most robust market. This worries me.

It feels that almost a month into this war, we (the West) seem too eager to believe that others will behave like we think they should when we have been horribly disappointed time and again.

I do believe that something “broke” in February and it will not be repaired. This realignment of global relationships, which was already occurring, will accelerate and shift the balances. It is up to us to identify the risks and opportunities. I continue to think that with respect to domestic energy and manufacturing, Canada, Mexico, and most of Latin/South America will benefit as we reposition ourselves.

However, given the strength of the rally last week, my outlook on the Fed (balance sheet reduction) and the war (no ceasefire, as much as I wish), I cannot be constructive on risk.

Tyler Durden

Mon, 03/21/2022 – 08:40