Wall Street’s Biggest Bear: This Is A “Vicious Bear Market Rally To Sell”, Stocks Will Drop Another 10-20% By Mid-April

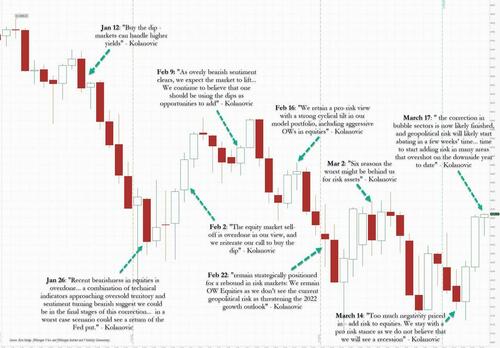

Two days after JPMorgan’s Marko Kolanovic spun the broken record and not once but twice in the past week told his clients to buy the dip, something he has been saying every single week in 2022 with less than stellar results…

… he is about to get another brand new dip to urge clients to buy. We can only hope said clients have any money left.

Meanwhile, while JPMorgan keeps digging its permabullish grave deeper with every passing week, Morgan Stanley’s bearish strategist Michael Wilson continues to build his credibility and fly circles above the rest of the Street which is desperately trying to extricate itself from its ridiculous trend-chasing optimism at the end of 2021, and one day after reminding clients that the current cycle is getting “late” and will burn out far sooner than expected, warning that the US economy could be in a downturn as soon as 5 months from now (read: recession) he is out with another note this morning in which he takes the diametrically opposite view of Kolanovic, and says that while “the rally in equities over the past week was one of the sharpest on record” and could go a bit higher, led by the Nasdaq and small caps, he remains convicted “it’s still a bear market and we would use this strength to position more defensively.”

But let’s back up. For those who missed his Sunday Start note published yesterday, Wilson reminds readers that a year ago, he published a note with his Economics and Cross Asset Strategy teams arguing this cycle would run hotter but shorter than the prior 3. His view was based on the speed and strength of the economic and earnings rebound post the 2020 recession, the return of inflation after a multi-decade absence, and an earlier-than-expected pivot to more hawkish Fed policy.

In light of this, last Friday Morgan Stanley published an update that shows developments over the past year support this call—US GDP and earnings have surged past prior cycle peaks and are now decelerating sharply, inflation is running at a 40-year high, and the Fed has executed the sharpest pivot in policy we’ve ever witnessed.

Meanwhile, just 22 months after the end of the last recession – which anyone with half a brain realizes never actually ended the prior business cycle as debt never dropped and in fact, spiked – Morgan Stanley’s Cross Asset team’s US cycle model is already approaching prior peaks, as we noted last night. By way of background, this indicator aggregates key cyclical data to help signal where we are in the economic cycle and where headwinds/tailwinds exist for different parts of the market. Of course, the latest rebound has been unusually fast (and artificial, on the back of tens of trillions in monetary and fiscal stimulus). The model is currently in the “expansion” phase (data above trend and rising—i.e., mid-to-late cycle), and as Morgan Stanley warns, “at this pace, the indicator could peak in 2-4 months and move to “downturn” 5-10 months from today.”

Stepping away from the economy and shifting attention to stocks, here too Wilson notes that “earnings, sales, and margins have all surged past prior cycle highs.” In fact, earnings recovered to the prior cycle peak in just 16 months, the fastest rebound going back 40 years.

Meanwhile, the early-to-mid cycle benefits of positive operating leverage have come and gone, and US corporates now face decelerating sales growth coupled with higher costs, according to Wilson. As such, the bank’s leading earnings model is pointing to a steep deceleration in EPS growth over the coming months and higher frequency data on earnings revision breadth are trending lower—driven by cyclicals and economically sensitive sectors—a set-up that looks increasingly “late” cycle.

Another reason behind Wilson’s conviction of a shorter cycle is his analysis of the 1940s as a good historical parallel. Specifically, back then excess household savings unleashed on an economy constrained by supply set the stage for breakout inflation… just like now. Developments since the bank published its original report in March of last year continue to support this historical analogue—inflation has surged, forcing the Fed to move off the zero bound aggressively in a credible effort to restore price stability.

Assuming the comparison holds, Wilson expects the next move to be a slowdown and ultimately a much shorter cycle. And although the end does not appear to be imminent, the slowdown in earnings that Wilson has been expecting looks incrementally worse than it did when he first published his fire and ice narrative last fall.

With that background in mind, and with the Fed finally raising rates this past week and communicating a very hawkish tightening path over the next year (something Powell did again just moments ago on Monday during his speech at the NABE annual conference), Morgan Stanley’s rates strategists are looking for an inversion of the yield curve in 2Q, although one look at the sharp inversions already observed in the 3s10s and 5s10s, there may be a risk this is Q1 business.

Here Wilson hedges somewhat – knowing well that it is very much frowned upon for established Wall Street strategists to predict a recession – and says that while curve inversion does not guarantee a recession (and he is not forecasting one), it does support his view for decelerating earnings growth “and would be one more piece of evidence that says it’s late cycle.”

It also justifies the bank’s reco toward defensively oriented stocks and sectors, which is looking increasingly appropriate as the Fed pivots and growth slows—i.e. fire AND ice.

Here, energy is the real outlier for obvious reasons which are not helpful economically speaking. Such leadership is reflective of very late cycle dynamics.

In addition to the above late-cycle analysis, Wilson also looked at what sectors do well when inflation is above trend and falling—a period he thinks is beginning now. He notes the fact that inflation is so high almost guarantees it’s close to peaking from a rate of change standpoint. Furthermore, the Fed’s aggressive pivot this past week should help, just as it did in the 1940s. Assuming that’s the right framework, the argument for defensive positioning is clear; it also tends to be bad for cyclicals relative to defensive and the market more broadly.

Wilson ends his macroeconomic tour de force recap by repeating his view that COVID did not create any real value for the economy or the average company: “In fact, it’s more likely that the pandemic destroyed value by exposing the fragility of just in time inventory systems and the outsourcing of manufacturing and other forms of labor.” It also may have impaired the domestic labor force in a way that will take years to fix, not to mention the government’s balance sheet, which puts potentially productive investments in infrastructure on hold. Furthermore, the damage from 40-year high inflation will also leave a scar on the consumer and businesses that may take a long time to heal.

The point of these comments, Wilson explains, “is that it doesn’t make sense that stock prices would be so much higher than the pre-pandemic levels, even adjusting for inflation and nominal prices. Yet, here we are.“

Here we are indeed… so does that mean that one should listen to Kolanovic and wait for future dips to buy and ride out until things normalize? Not at all according to Wilson, who boldly takes the other side of Kolanovic’s trade reco (i.e., the same as JPM’s trading desk), and notes that his primary out of consensus call for 2022 was that “valuations were too high and ripe for a de-rating.” Fast forward to today, and it’s fair to say that call has played out, something no other Wall Street strategist can claim, certainly not those permabulls from Goldman or JPM.

The rationale for Wilson’s view has been two-fold: the Fed was going pivot to a more hawkish position than most expected (“fire”) while growth was likely to slow (“ice”). As part of this framework, Wilson set his target at 18x forward 12-month EPS, which assumed a 2.1% 10-year Treasury yield and an equity risk premium (ERP) of 350bps.

Since establishing that view in mid-November, a lot has happened that Wilson’s “fire and ice” narrative has only gotten more extreme.

First, the Fed’s action in January left the consensus convinced it will hike Fed Funds another 175 bps over the next year and reduce its balance sheet by half a trillion dollars. This has taken 10-year yields past the bank’s prior year end targets of 2.1%. As such, MS rates strategists forecast 10-year yields to now end the year at 2.4%, with a bull case of 2.1%. The good news is that most of the damage is done now on rates and that has been reflected in PEs. At the lows last week, the S&P 500 traded right to our 18x target and then stopped. So, as Wilson reveals, “many are now asking us if that was enough.”

The answer, it should come as no surprise, is no.

As Wilson explains, the overall macro environment has gotten worse, “which means we are likely to undershoot our 18x target, to the downside. The Fed (and other central banks) are very focused on inflation, and Russia’s invasion of Ukraine only increases the pressure on prices, especially food and energy. Meanwhile, the situation is weighing further on both consumer and business confidence, which is not good for growth, nor is it priced.”

How do we know? Well, as noted, the PE is a function of 10-year yields and ERP. Think of rates as the component of PEs that reflects Fed tightening as well as growth and inflationary pressures. While many bond market participants are looking for the 10- year to back up much further, Morgan Stanley does not, particularly in the near term. In other words, the rates market has adjusted appropriately and fully reflects the Fed’s pivot as it stands today. However, the entire PE compression since November is due to rates, while the ERP has remained flat

That means that the ERP has not adjusted for the rising risk to growth, whether that’s geopolitical concerns, or the earnings risk from payback in demand, margin pressure from inflation and/or rising inventory.

So how much higher should the ERP be? That’s a debatable question, but as Wilson has shown in prior research, just based on market volatility, one could argue the ERP is now 150bps too low

Similarly, given the substantial rise in investment grade credit spreads, one would expect the spread on equities would have risen proportionately. But that is not the case, instead we see that IG credit spreads widened significantly more than the ERP over the past month with the differential increasing last week. This is one of the reasons Wilson says he sold stocks last week and bought both long duration Treasuries and US investment grade credit in his Wealth Management asset allocations. Wilson also continues to like long duration bonds as a cheap hedge against a growth scare that could become the focus of markets as we move into April, something ERPs are not pricing.

Another question is how low can P/E multiples go?

In recent notes, Wilson discussed this overshoot on PEs and suggested 16x NTM EPS as a level where we would get interested. That math is very simple as laid out in the matrices below

Bottom line, with rates having moved higher even faster than expected this year and the geopolitical environment deteriorating substantially, Wilson believes a much more realistic PE to think about adding equity risk is closer to 16x, if not lower. Based on the still strong NTM EPS forecast of $232 implies the S&P 500 is 10- 20% over valued after last week’s rally, according to Wilson.

And speaking of last week’s rally, it still lines up with Morgan Stanley’s price analog from 2018 on time although it’s not nearly as tight on price as it was earlier in the month.

Nevertheless, it still provides a loose guide when thinking about the next down leg, which the MS strategist expects to be completed by mid/late April,and is why he recommends that “investors use last week’s strength as an opportunity to get more defensive if they haven’t already.”

Wilson’s bottom line: “last week was nothing more than a vicious bear market rally, in our view, and while it may not be completely finished, it is a rally to sell.”

One final point from Wilson who notes that when looking at the major indices, it appears that the Nasdaq and Russell 2000 may have more upside than the S&P 500 should the rally continue into this week: “This is merely a function of the fact these indices sold off harder and are further below their respective 200-day moving averages. There is also a larger short base in these indices and they would likely benefit from a pause or even reversal in back end rates, especially the Nasdaq.” However, even with a rally, both of these indices’ relative strength have broken down, and until that changes, they are not attractive on a relative basis from an investment perspective beyond this technical bounce.

Tyler Durden

Mon, 03/21/2022 – 14:46

Recent Comments