Morgan Stanley: We Could Be In A Downturn 5-10 Months From Now

by Michael Wilson, chief US equity strategist at Morgan Stanley

A year ago, we published a joint note with our economics and cross-asset strategy teams arguing that this cycle would run hotter but shorter than the prior three. Our view was based on the speed and strength of the economic and earnings rebound following the 2020 recession, the return of inflation after a multi-decade absence, and an earlier-than-expected pivot to more hawkish Fed policy. On Friday, we published an update that shows developments over the past year support this call – US GDP and earnings have surged past prior cycle peaks and are now decelerating sharply, inflation is running at a 40-year high, and the Fed has executed the sharpest pivot in policy we’ve ever witnessed.

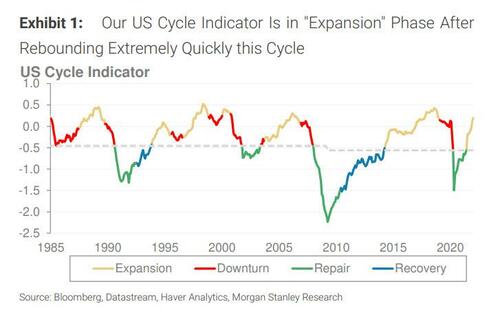

Meanwhile, just 22 months after the end of the last recession, our cross-asset team’s US cycle model is already approaching prior peaks. This indicator aggregates key data to help signal where we are in the economic cycle and where headwinds/tailwinds exist for different asset classes, styles, etc. The latest rebound has been unusually fast. The model is currently in the ‘expansion’ phase (data above trend and rising – i.e., mid-to-late cycle). At this pace, the indicator could peak in 2-4 months and move to ‘downturn’ 5-10 months from today.

With regard to US equities, earnings, sales, and margins have all surged past prior cycle highs. In fact, earnings recovered to the prior cycle peak in just 16 months, the fastest rebound going back 40 years. The early-to-mid-cycle benefits of positive operating leverage have come and gone, and US corporates now face decelerating sales growth coupled with higher costs. As such, our leading earnings model is pointing to a deceleration in EPS growth toward zero over the coming months, and higher-frequency data on earnings revision breadth are trending lower – driven by cyclicals and economically sensitive sectors – a set-up that looks increasingly ‘late’ cycle.

Another key input to the shorter-cycle view was our analysis of the 1940s as a good historical parallel. Specifically, excess household savings unleashed on an economy constrained by supply set the stage for breakout inflation both then and now. Developments since we published our report in March last year continue to support this historical analogue – inflation has surged, forcing the Fed to move off the zero bound aggressively in a credible effort to restore price stability. Assuming the comparison holds, the next move would be a slowdown and ultimately a much shorter cycle. While the end – i.e., recession – does not appear to be imminent, the slowdown in earnings we’ve been expecting looks incrementally worse than it did when we first published our ‘fire and ice’ narrative last fall.

Further analysis of the post-World War II evolution of the cycle (1947-48) reveals another interesting similarity to the current post-Covid phase – unintended inventory build from over-ordering to meet an excessive but unsustainable pull-forward of demand. Regular readers of our research should be familiar with this as a dynamic we have written about. In short, we think the risk of an inventory glut is growing this year, particularly in areas of the economy that experienced well above-trend demand like Consumer Discretionary and Technology goods.

Now, with the Fed raising rates this past week and communicating a very hawkish tightening path over the next year, our rates strategists are looking for an inversion of the yield curve in 2Q. Curve inversion does not guarantee a recession, and our economists don’t expect one. However, it does support our view for sharply decelerating earnings growth and is one more piece of evidence that says it’s late cycle.

In terms of our US strategy recommendations, we continue to lean defensive and focus on companies with operational efficiency and high cash flow generation. This leads us to names with more durable earnings profiles that are also attractively priced. Pharma, Insurance, Real Estate, Utilities, Food/Beverage/Tobacco, and Telecom all screen relatively well – i.e., defensive cohorts. Growth stocks may benefit as the curve flattens, but such a move should be faded before 1Q earnings season begins and more companies come to the confessional. This same analysis also supports our underweight in Consumer Discretionary goods, with Retailing and Consumer Durables & Apparel screening poorly. Cyclical Technology stocks also look vulnerable to the payback in demand that has yet to fully play out.

Tyler Durden

Sun, 03/20/2022 – 16:00

Recent Comments