These Charts Show Russia’s Invasion Choking World Of Natural Resources

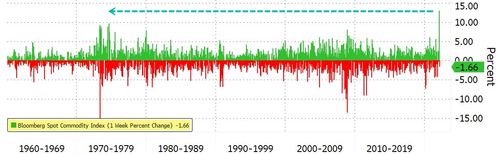

For weeks, we’ve detailed how Russia’s invasion of Ukraine has sparked one of the most significant commodity shocks the world has ever experienced. It even supersedes changes to commodity markets in the 1970s and involves every commodity from grain to fertilizer to crude to metals.

In a series of charts (provided by Bloomberg), we will show just how the Ukrainian conflict and Western sanctions on Russia are choking the world’s supply of natural resources, driving up prices.

Russia is a top exporter of many commodities.

Here is the share of Russian exports for each region of the world. The U.S. and allies implementing bans on Russian crude and other commodity exports have disrupted global trade and unleashed supply constraint fears (here’s why banning Russian crude imports is risky).

Anyone who has filled up their fossil fuel vehicle has noticed prices at the pump have soared since the invasion. That’s because Russia is the second-largest crude exporter globally, behind Saudi Arabia. The U.S., U.K., and Canada have banned imports of Russian imports, sending energy markets into turmoil.

China, Germany, Poland, and the Netherlands are some of the top regions that receive Russian crude. Any loss of oil will impact refineries and their ability to produce crude products.

Russia is the second-largest exporter of gasoline and diesel, right behind the U.S. Their largest export market is Europe.

France, Germany, Turkey, and the U.K. guzzle the most Russian gasoline and diesel per day by volume. A supply shock has already caused soaring prices and shortages as European countries shun purchases from Russia.

Russia also happens to be the largest exporter of natural gas. Most of it ends up in Europe. Moscow has already threatened to cut supply as European leaders search for suppliers elsewhere.

Germany is the largest receiving country of Russian natgas through pipelines.

Russia is third in the world for thermal coal exports used in power plants. Europe is the largest buyer of Russian coal.

Here are the largest buyers of Russian thermal coal.

When it comes to agricultural exports, Russian wheat is exported worldwide. Russia and Ukraine have halted wheat exports that will impact global food supplies. The outcome could be an imminent starvation crisis. One could also be brewing in the US.

As for edible oils, Russia is the second-biggest shipper of sunflower oil.

Russia is also a top supplier of fertilizer. Moscow has reduced or halted nutrient exports.

A decline in fertilizer exports will make it harder for farmers in Europe, South America, and Asia to have robust harvests this year that could strain the global food supply even more.

Russia is a key supplier of industrial and precious metals. It’s among the top players in exporting nickel, a critical metal for electric car batteries. China, Europe, and the U.S. are the largest buyers of Russian nickel. Tesla has raised car prices twice in the last few weeks because of soaring nickel prices.

Most of the world relies on Russian aluminum.

Russia is the second largest exporter of palladium and platinum in the world.

The US, UK, Japan, and Hong Kong are the top importers of Russian palladium, used primarily in catalytic converters for automobiles.

Russia is also the world’s third-largest steel exporter.

The West trying to isolate Russia from the global economy with devastating sanctions and restrict its trade worldwide produces unimaginable inflation that could send the world into a stagflationary hellhole (the US bond market is warning about impending doom). Shortages of commodities could develop as prices skyrocket.

Could all of these disruptions suggest the next world war has begun? Billionaire Bill Ackman thinks so.

Tyler Durden

Sat, 03/19/2022 – 09:55