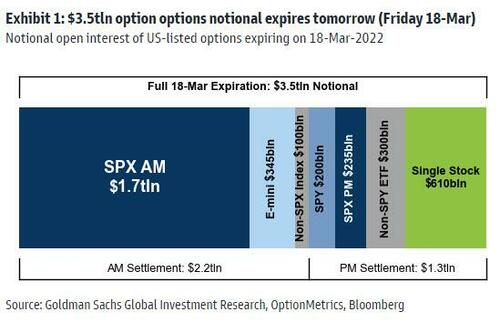

Here Are The Key Stocks/Levels To Watch During Today’s $3.5 Trillion Quad-Witch OpEx

While index options are the key focus ahead of today’s huge quarterly expiration, there is still a sizable $610bn of single stock options are set to expire today.

And, as we have touched upon during all previous quad-witches, today’s expiry could be important for stocks with large open interest in at-the-money (ATM) option, and market makers delta-hedging large options portfolios will be active. As Goldman so helpfully puts it, “this flow is likely to dampen volatility in some names while exacerbating stock price moves in others.”

So with that in mind, here is a list of stocks where a large percentage of contracts, relative to their average daily volume traded, expire today, potentially leading to “pinning,” with large-caps such as CI, TTWO, UPS, and AMGN standing out:

However, back to the broader index, where SpotGamma sees roughly 1/3 of the total S&P/QQQ options position expiring today. For both the SPX & SPY the 440/4400 strike is dominant, and we look for a pinning around this area for today. The chart here shows just how large this 440 call position is.

Because of the substantial rally in markets over the past few days, the Monday OPEX “hedge clearing” day is a bit more cloudy. This is because the large put positions have been crushed before OPEX, which may reduce the related hedge unwind for Monday. Recall back to January when the market was careening lower into Friday OPEX, and mid-day on Monday markets bounced. This time the OPEX energy, so to speak, has arguably been discharged.

Therefore we will enter Monday with a reduced notional gamma, which implies less dealer hedging impact.

Rather ominously, SpotGamm warns that if we were to map out the landscape, it seems to compare well to January. There is a bit of call interest >=4400 which could contain markets (black circles).

However a stock break down does not have support from the options market, and in fact could easily be fueled lower.

This is our big concern here – should selling pick up and hedge demand (i.e. put buying) renew – that brings short stock demand from dealers and a resulting spike in IV with less starting support.

SpotGamma thinks if selling arrives, the “lower bound” that was near 4100 has moved down to 4000. As a reminder the ’22 equity market low was the 2/24 “official” conflict date – despite the fact that both credit & commodity markets deteriorated into March.

Tyler Durden

Fri, 03/18/2022 – 08:57