European Automakers “Do Not Look Expensive” Even Under Distressed Scenarios, Goldman Says

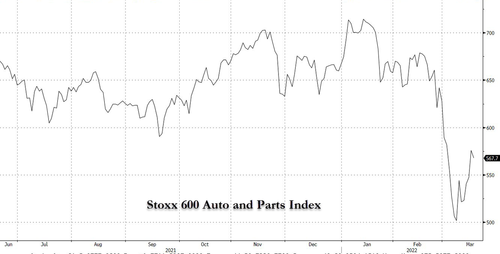

Goldman Sachs is out defending European Automakers this week, claiming that a drop in the Stoxx 600 Automobiles & Parts Index that has been ongoing since the beginning of February may have already priced in a “stressed” scenario.

The investment bank said in a note this week that downside to 2021 volumes is “likely to be limited” and that while it “doesn’t see significant risk to volume vs 2021 from demand”, it sees “price/mix most at risk if demand softens due to macro”, according to a Thursday morning wrap-up by Bloomberg.

The bank predicted that energy inflation wouldn’t have a “material impact” on COGS and that impacts of energy prices are “low at this point”. The bank has still cut its EBIT estimates by 2%/4% and 14%/11% on average for 2022/23 for carmakers, Bloomberg noted.

Despite these cuts, the bank says that auto names like BMW and Stellantis “do not look expensive even under our stress scenario”.

Recall, just days ago we highlighted when Volkswagen’s CEO said that the Ukrainian war could be worse for European autos than Covid was.

A prolonged war in Ukraine would be “very risky” for the European and German economies, Volkswagen CEO Herbert Diess told the FT in an interview published last week. He said the economic damage from the war could be “very much worse” than the pandemic:

“The interruption to global supply chains could lead to huge price increases, scarcity of energy and inflation,” Herbert Diess, chief executive of the German carmaker, told the Financial Times.

“It could be very risky for the European and German economies.”

The warning, from one of Europe’s most authoritative business leaders (since Volkswagen is still Europe’s biggest car maker by sales volume), is just the latest reminder that the ripples from the conflict are being felt far away from the battlefield.

Parts suppliers and auto makers like Stellantis, Daimler, BMW, Volkswagen and Renault have all been on watch for weeks now, not just due to the semi shortage and the conflict in Ukraine, but also due to a lackluster end to 2021 in terms of vehicle registration data, which fell 22% to end 2021.

Whether or not Goldman is correct and the worst of the risk for autos has passed remains to be seen, however…

Tyler Durden

Fri, 03/18/2022 – 04:15