One Bank Translates What Powell Really Said: We Are Now Pricing The Rate Cuts And QE That Will Follow The Fed’s Policy Error

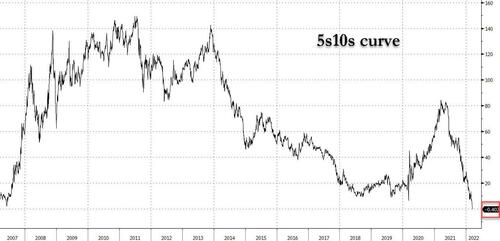

Two weeks ago we presented a rough preview of what comes next in “A World At War” – Global Recession Next, And Then QE5“, where the only catalyst missing was the trigger for the coming recession. Helpfully, the Federal Reserve provided just that yesterday when in a surprisingly hawkish pivot, Powell not only hiked – as expected – but telegraphed an additional 6 rate hikes in 2022, double the 3 penciled in previously. And since the US economy is already slowing and will soon be in recession – facilitated by none other than the Fed – a dynamic which we described last night in “Hawkish Surprise Triggers Inversion, Countdown To Policy Error And Next Recesssion” and which has manifested most vividly in the inversion of the 5s10s yield curve…

… and the more than two rate cuts priced in by the forward OIS market as of this morning.

We are not the only ones who harbor such a fatalistic outlook on the Fed’s endgame. In his FOMC post-mortem, Rabobank’s Fed watcher Philip Marey writes about the Fed’s remaining 6 rate hikes and notes that “given the deteriorating global economic outlook, we have our doubts whether the FOMC will deliver before the end of the year. Indeed, in the next few meetings (May, June, July) we expect the Committee to continue hiking 25 bps per meeting. However, by the September meeting the damage from the Ukraine crisis to the global economy may become a threat to the US economic expansion. The doves in the FOMC are likely to jump from the hiking bandwagon by then and demand a pause. Powell could point to the additional benefit of assessing the impact from the initial four hikes, before resuming the hiking cycle.” (full note available to pro subs).

Of course, if BofA’s Michael Hartnett is right, by September – just two months before the midterms – the US economy will be in a full-blown consumer-led recession, however with the political implications of such an admission right before the midterms, we don’t expect that the data will “confirm” a recession has started until December or the start of 2023, after the Democrats’ historic loss in the upcoming midterms.

Putting it all together, Marey’s Rabobank colleague Michael Every picks up where we left off with our FOMC post-mortem, and writes that “the market is going even further. With 30-year yields dropping and US 5-10s inverting, and only 20bp to go on 2s-10s, and with stocks, gold, and crypto all up, we are now pricing for a policy error and the inevitable rate cuts and new QE that will have to follow.” In other words, and as we have been hammering for months, “just as the Fed drives things off a cliff, Mr Market is already pricing in the trampoline at the bottom of it that will take us to even higher market-y highs.”

It’s also why between record downside protection in the form of index puts…

… and expectations that we are approaching the Fed put, which according to the latest FMS is now at 3,636 down sharply from February …

… the market will have difficult selling off from here knowing that at any moment, the Fed could reverse and frontrun its own bailout of risk assets, similar to what Beijing just did yesterday with its latest wholesale rescue of local stocks.

Yet longs should be prepared that it won’t be smooth sailing from here until the next QE: as Every asks, “are markets right about the policy error? Yes. But are they right to ignore all the pain to come and to presume the Fed will do what it always does, and provide them with so much free stuff they look like Smaug the dragon, sleeping under a pile of treasure? Here is where fingers are being crossed, because if an angry, unequal, polarised society finds out it has turned into Japan without any of its former social contract, don’t think politics, and the politics of central banking, can’t change. Then even dragons get toasted.”

The question is just how many dragons get toasted before even Powell realizes that – Biden’s complaints about inflation be damned – he is risking the Fed’s entire risk-inflating legacy and that if stocks aren’t propped up, a second consecutive generation of Americans will capitulate and never again touch the stock market.

Tyler Durden

Thu, 03/17/2022 – 12:45

Recent Comments